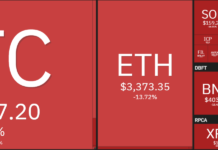

One of the primary reasons why some people still balk at the idea of using cryptocurrencies is that they can rapidly fluctuate in value. When that happens, people can lose the worth of their investments overnight or find that the price they paid for something today doesn’t match what it will be tomorrow.

That aspect of uncertainty can make people decide that even though some things about cryptocurrencies appeal to them, they’d rather stick with fiat ones.

However, the development of stablecoins aims to get rid of that uncertainty and help people feel more eager to invest in cryptos. Stablecoins are cryptocurrencies pegged to other stable assets, like the U.S. dollar or gold. Recent reports indicate that the Federal Deposit Insurance Corporation (FDIC) will back a stablecoin. Here are some more details.

The FDIC Protects Americans if Banks Fail

In the 1920s and 1930s, bank failures were common. If Americans didn’t get their funds out before those institutions collapsed, they had no way to recover their savings. The Federal Deposit Insurance Corporation (FDIC) aimed to change that problem. It was part of the Glass-Steagall Act of 1933 and gave a set amount of insurance — currently, $250,000 per depositor — in case a particular bank went under.

The goal of the FDIC was to increase consumer confidence about the safety of their deposits. People choosing a new bank should always make sure the institution’s website or something within the documentation about the bank indicates it is FDIC-insured.

The FDIC and Cryptocurrencies

There’s been a recent movement to create more stablecoins, but a development with IBM marks the first time that people investing in cryptocurrencies could get FDIC protection. It involves several companies working together. In short, IBM partnered with a blockchain called Stellar, which shares its blockchain technology with Ripple.

A startup called Stronghold then came into the picture to launch USD Anchor. The cryptocurrencies associated with it have the backing of an equivalent number of U.S. dollars deposited at FDIC banks. An anchor is like a bridge between fiat currencies and the Stellar network.

According to content from Stronghold, that company describes itself as operating like a local bank under Stellar, which is the parent company. All crypto transactions except for those occurring in Lumens — Stellar’s native currency — have credit issued by anchors such as Stronghold.

The final company in the process is Nevada-chartered Prime Trust. It holds the one-for-one-backed U.S. dollars associated with the cryptocurrencies and deposits the fiat currencies into FDIC-insured banks. Since the FDIC insures the fiat currencies connected to those cryptocurrencies, their value remains stable.

Cryptocurrencies and FDIC Regulations

As cryptocurrencies have become more popular over the last several years, federal agencies have stepped in to figure out how to regulate them. For example, the Securities and Exchange Commission (SEC) requires the registration of any cryptocurrency classified as a security, as well as exchanges. Also, the FDIC oversees more than deposit insurance for the insured banks.

As a start, the FDIC mandates that banks must keep electronic records, including emails, to comply with the E-Sign Act. Many employees in the banking sector take continuing education courses to stay current about the rules surrounding electronic banking records and other aspects of the FDIC. Doing that helps them get prepared in case of an audit.

In 2018, Sheila Bair, the former chair of the FDIC, asserted it was time to have a federal framework for cryptocurrencies and that Congress should create more rules surrounding them. One of the things people traditionally like about cryptocurrencies is that they can use them without having to deal with banks. Plus, the lack of regulation attracted some people who wanted to control their investments without oversight.

However, now that the FDIC is getting involved with the cryptocurrency that’s getting the go-ahead from IBM, more regulation could be on the way depending on how that initiative pans out.

A Better Way to Conduct Cross-Border Payments

IBM is kicking off this FDIC-backed project with a plan to improve cross-border payments through something called IBM Blockchain World Wire. It lets cross-border payments happen in near real-time instead of the days it may take now. All transactions get recorded on the blockchain, and as of now, the payments are accepted in more than 50 countries.

This solution could allow cross-border payments to happen without intermediaries, making them not only faster but also nearly seamless.

IBM is not the only one seeking to improve these payments in the crypto space. Reports say J.P. Morgan will offer a cryptocurrency that will function like a stablecoin. In a broad sense, using systems built on the blockchain to transfer money could help people save on fees and give them more convenience than traditional money transfer services offer. However, the new options could have truly life-changing effects on people in developing countries.

Mobile money platforms allow people to send and receive money even if they don’t have bank accounts. In places like Kenya, those possibilities have brought an estimated 2% of households out of extreme poverty and presented more opportunities, such as ways for women to get involved in legitimate sources of income.

A Promising Future Ahead

So far, IBM’s venture into FDIC-backed cryptocurrency only extends to cross-border payments. It’s not hard to envision, though, the further options that could exist once people start working with cryptos that don’t fluctuate. Then, the people who might have initially not liked the fact that the value could change without warning might decide that now is the time to invest.